Massachusetts Paid Family Medical Leave (PFML) Rates

MA PFML Insurance

CALL US 800-426-2413 OR SEND US AN E-MAIL TODAY TO GET YOUR FREE PRIVATE OPTION PFML RATE

In Massachusetts, although you are required to provide PFML, you have the option of joining the state’s insurance program OR getting your PFML insurance through a private carrier!!

We now have ten insurance carriers that can provide you with PFML coverage at rates the same or lower than the .75% or payroll being charged by the Commonwealth of Massachusetts. Right now we provide this private coverage to over 50 companies in Worcester and throughout Massachusetts.

Let us give you one example of a company with a $5,000,000 annual payroll:

- Commonwealth of Massachhuetts at .75%: $37,500 in annual premiums

- Private Carrier at .49%: $24,500 in annual premiums

** private carrier rates guaranteed for two years

** Commonwealth of Mass guaranteed through the end of 2021

There is a lot more to employee benefits then premiums, like ease of premium billing and claims processing. Would you rather work with a private carrier and us with your billing and claims or a government bureaucracy??

We provide real live people to call or e-mail with any benefits, premium or claims questions!!! What are you waiting for ????

Read us quoted in this Boston Globe Column

But Bill Randell, president of Advantage Benefits Group in Worcester, envisions a scenario in which the state program becomes akin to a high-risk pool. The state gets stuck with all the high-risk employers — the ones with low pay and high turnover — and needs to keep raising rates as a result. He says state officials never anticipated this many companies would get exemptions, especially so soon.

PAID FAMILY MEDICAL LEAVE RATES

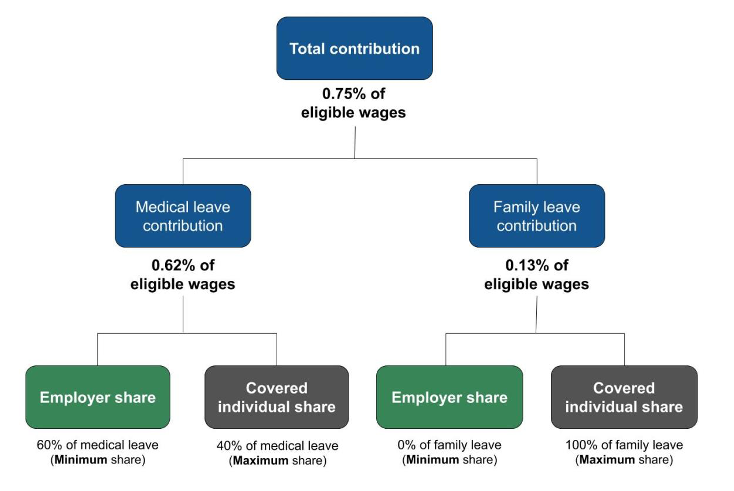

Effective for 2021 the rate the Commonwealth of Massachusetts will charge you is .75% of your payroll with 25 or more employees.

Please note, this is very important, the rate can be readjusted in January of 2021. If claims are bad this year, you can expect an increase in 2022.

Employers with 25 or more employees:

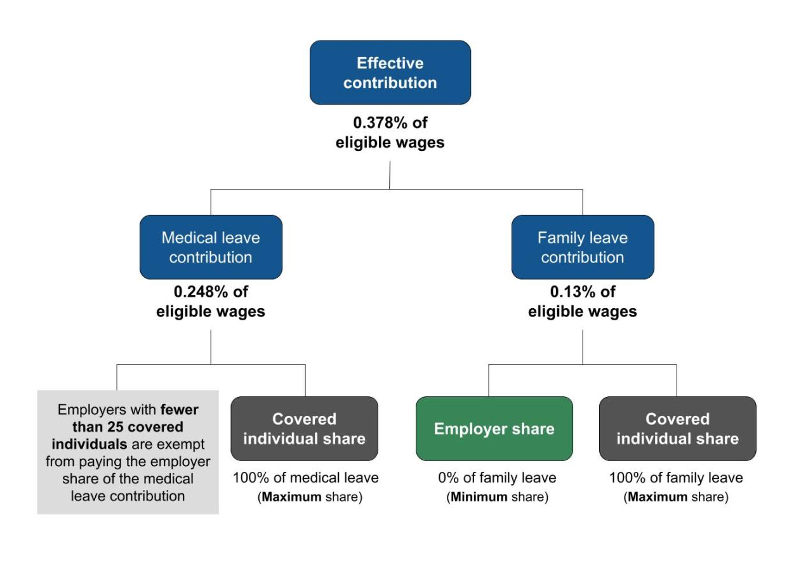

If you have less then 25 employees, the rates drops to .378% of pay since the employer under 25 are not being charged.

SHORT-TERM DISABILITY PLAN TO SUPPLEMENT PFML

Now that you have had to adopt PFML and you have cancelled your short-term disability insurance, we have noticed two problems that have arisen.

Employees earning $1270 per week will max out on the $850 per week of PFML benefits

- For Employees earning less than $715.83, the benefit will be 80% of their pay. If you earned $715.83, the weekly benefit would be $572.66.

- For employees earning more than 50% of the State Average, they will receive a benefit of $572.66 PLUS 50% of the average weekly wage that is more than $715.83 to the max cap of $ 850

Paid Family Medical Benefits max out at 20 weeks, while your long-term disability policy starts after 26 weeks?

Buy a Short-term disability insurance policy that 1) pays benefits to those employees earning more then $1270 per week and 2) pays benefits after 20 weeks for 6 weeks until Long-Term Disability benefits begin.

Here is a more detailed explanation about PFML provided by the Commonwealth of Massachusetts.

What is PFML?

Paid Family and Medical Leave (PFML) is a state program that offers up to 26 weeks of paid leave for medical or family reasons to eligible employees in Massachusetts. PFML is funded through employee and employer contributions, and is separate from both the federally mandated benefits offered by the Family Medical Leave Act (FMLA) and other family and medical leave benefits offered by employers.

PFML Program Details

As a Massachusetts employer, your required contributions under the Paid Family and Medical Leave (PFML) law are based on the size and makeup of your workforce. That’s why it’s so important that you accurately report this information.

For 2020, your contribution responsibilities depend on your average number of covered individuals from the 2018 calendar year (Jan. 1 – Dec. 31).

Determining your Massachusetts 2018 workforce count will help you answer two important questions:

- Whether or not your 1099-MISC contractors are considered covered individuals.

- Whether or not you’re responsible for paying any share of the contributions.

How do I count my Workforce?

Your total workforce includes:

- Massachusetts W-2 employees (full-time, part-time, or seasonal).

Generally PFML follows the same eligibility criteria as the unemployment insurance program in Massachusetts. If you are required to report a W-2 employee’s wages to the Department of Unemployment Assistance (DUA), that employee should be counted. Employees don’t need to live in Massachusetts to be covered. W-2 employees are always covered individuals.

- Massachusetts 1099-MISC contractors.

Generally, a MA 1099-MISC contractor is an individual for whom you are required to report payment for services on 1RS Form 1099-MISC. 1099-MISC contractors are only covered individuals if they make up more than 50% of your workforce and meet certain criteria:

- They must perform services as an individual entity.

- They must live in Massachusetts.

- They must perform services in Massachusetts.

FYI: If you own a business and pay yourself through a W-2, you are an employee of that business and will be considered part of your covered workforce under PFML

Counting your MA workforce:

- Add up the total number of MAW-2 employees you paid each pay period in 2018 and divide that number by the number of pay periods. This is your MA W-2 average.

- Add up the total number of MA1099-MISC contractors you paid for services each pay period in 2018 and divide that number by the number of pay periods. This is your MA 1099-MISC average.

- If your MA 1099-MISC average is greater than your W-2 average, then your MA 1099-MISC contractors are considered covered individuals.

- Add up your total number of covered individuals in 2018.

If you had 25 or more covered individuals in your workforce in 2018, then you are responsible for making employer contributions for covered individuals in your workforce. (Please see the flow chart above.)

If you had fewer than 25 covered individuals in 2018‘s workforce, you do not need to make an employer contribution. However, you will still need to send the state the employee portion of the contribution on their behalf. (Please see the flow chart above.)

AS AN EMPLOYER HOW MUCH DO I HAVE TO PAY?

Now that you know who is a covered individual, you can determine what employer contributions you are responsible for. Even if you are not required to pay an employer contribution, you will be required to send the employee’s contribution to the state on their behalf. You can also elect to cover up to 100% of the employee contribution, regardless of your obligation.

Employers are responsible for sending family and medical leave contributions to the Department of Family and Medical Leave (DFML) through MassTaxConnecton behalf of their covered individuals. Larger employers who had 25 or more covered individuals are responsible for paying a share of the required contributions. Employers who had fewer than 25 covered individuals are not required to pay the employers share of contributions but must still send payment on behalf of their covered individuals.

The maximum amount of earnings subject to these contribution rates in 2020 is $137.700 annually for each covered individual.

Employers can choose how much of their PFML contribution they withhold from their covered individuals as long as they don’t exceed the maximum percentages listed on the following pages. For example:

- An employer with employees covered by multiple collective bargaining agreements can vary the amounts it withholds from employees within each of those bargaining units.

- An employer can take different amounts from their full-time and part-time staff.

Consult with your legal counsel on the advisability of implementing different percentages in your organization.

Employers who had 25 or more covered individuals will be required to send a contribution to DFML through MassTaxConnect of 0.75% of eligible wages. This contribution can be split between covered individuals’ payroll or wage withholdings and an employer contribution.

WHAT DO I HAVE TO TELL MY WORKFORCE ABOUT PFML?

You are legally required to inform your workforce about PFML Here’s what you have to do.

- Hang up a PFML poster.

You must post this poster at your workplace in a location where it can be easily read. We suggest you place the poster with other mandatory workplace posters, like wage and hours laws, workplace discrimination, workers’ compensation, and workplace safety. The poster must be available in English and each primary language of 5 or more individuals in your workforce if these translations are available from PFML.

- Notify your W-2 and 1099-MISC contractor (if eligible) workforce.

You’ll need to notify your MA workforce in writing about available PFML benefits. You must issue this notice to each new employee within 30 days of their first day of employment. The notice must be written in each employee’s primary language. You must get a written statement from each employee either acknowledging or refusing to acknowledge the notice. Please retain these forms. Do not send these forms to DFML You may download a template of this notice provided by DFML or create your own. If you choose to create your own notice, it must contain:

- An explanation of the availability of family and medical leave benefits

- The covered individual’s contribution amount and obligations

- The employer’s contribution amount and obligations

- The employer’s name and mailing address

- The employer identification number assigned by DFML (FEIN)

- Instructions on how to file a claim for family and medical leave benefits (once available)

- The mailing address, email address, and telephone number of DFML

If less than 50% of your workforce includes MA 1099- MISC contractors, you’re not required to inform them of PFML benefits, though it’s encouraged so those contractors are aware they may opt-in to the program.

IMPORTANT PAID FAMILY MEDICAL LEAVE LINKS

- Commonwealth of Massachusetts Department of Family Medical Leave (DFML) has a real good website that can answer pretty much any question that you have.

- Commonwealth DFML claim form

- Standard Insurance, private carrier, has a great page that follows PFML around the country

- PFML Interactive Map

CONTACT US

Advantage Benefits

78 Pleasant Street

Suite 300

Worcester MA 01609

Vanessa Costa 508-494-8303 cell Vanessa@AdvantageBenefits.com

Bill Randell 508-414-8305 cell Bill@AdvantageBenefits.com